can you go to jail for not paying taxes in florida

5000 25000 fine andor imprisonment for 1 3 years. Can you go to jail for not paying taxes.

Is Jail A Possibility If You Fail To Pay Your Taxes Frost Law Maryland Tax Lawyer

What Happens When You Dont Pay Your Taxes.

. Failure to pay tax collected. In some cases if you do not pay for child support you may end up going to jail for this offense. This goes without saying that you should still make it a point to file your returns and pay your taxes on time to avoid IRS penalties.

Up to 25 cash back In Florida the tax collector must send you a notice by mail or electronically if youve agreed to receive notice this way by April 30 if your payment hasnt been received. Income Tax Rate Indonesia. Restaurants In Matthews Nc That Deliver.

If youre a corporate officer you can go to jail over failure to pay federal withholding taxes also known as trust fund taxes. Some states charge a failure to file penalty even if you do not owe anything. Imprisoned forup to three years OR.

If you are more than 30 days late on a child support payment your debt may be reported to a credit agency. Jail for Not Paying Civil Fines or Criminal Justice Debt If you dont have the money to pay court costs or fines the outcome depends on your state of residence. Felony if tax not paid is 1000 or more.

Read below to learn more about possible consequences if you fail to pay your taxes. For further questions please share them in the comments section below. Refusal to pay taxes counts as tax evasion which is a federal crime.

Opry Mills Breakfast Restaurants. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in. Audit rates have reached an all-time low.

Yes but only in very specific situations. Its best to pay your tax returns promptly. Fined up to250000 for an individual offender or 500000 for a corporation OR.

You can go to jail for not filing your taxes. The notice will include a description of the property and a statement that a tax certificate may be sold if the taxes arent paid. While there is no easy explanation to this question the short answer is maybe.

It can take many forms including not reporting income claiming expenses for work not actually performed or owed or simply not paying taxes. To better understand these distinctions take a closer look at when you risk jail time for failing to pay your taxes. The first debt that you can indeed be prosecuted and put behind bars for is failure to pay taxes better known as tax evasion or in the words of the IRS tax fraud.

Further if you are caught helping someone evade paying taxes you can also be arrested and charged with this crime. However you cant go to jail for not having enough money to pay your taxes. Tax evasion is defined as any action taken to evade the assessment of federal or state taxes.

Wisconsins criminal failure to file sales tax penalty is a misdemeanor. Delivery Spanish Fork Restaurants. The credit agency can contact you to collect.

Can you go to jail for not paying child support in canada depends on the judges decision. The following actions will land you in jail for one to three years. Soldier For Life Fort Campbell.

500 5000 fine andor imprisonment for up to 6 months. In 2016 the IRS launched nearly 3400 investigations related. The short answer is.

At any rate failing to file a state tax return will lead to FTF penalties in most cases whether it is individual corporate sales or capital gains tax. The short answer is YES you can go to jail for not remitting Florida sales tax that your business collected. Misdemeanor if tax not paid is less 1000.

James Douglas Pielsticker the former CEO of Arrow Trucking was sentenced to 75 years over unpaid payroll taxes and the CFO Jonathan Leland Moore was sentenced to 35 months in prison for conspiracy to commit bank fraud and to. Not paying your taxes is a non-jailable offense if purposeful tax evasion has been ruled out. Well walk you through those scenarios and help you understand the true consequences of not paying your taxes.

You may even face wage garnishment or property seizure. Actually Florida laws on sales tax fraud are some of the toughest in the country punishable by up to 30 years in jail and 10000 in fines. It is a federal crime for which you can receive up to five years in prison for each offense of which you are convicted.

In the United States tax evasion can land you a prison sentence of up to five years. The short answer is maybe. But that doesnt mean you can get complacent.

Failure to do so can have numerous repercussions including fees property seizures court summons and yes jail time. Both a fineand imprisonment plus the prosecution costs. According to the Tax Policy Center the IRS audits less than 1 of individual and partnership returns.

In short yes you can go to jail for failing to pay your court-ordered child support. Essex Ct Pizza Restaurants. Virginia s FTF penalty is 6 per month but only if your tax return is more than six months late.

This may have you wondering can you go to jail for not paying taxes. The good news is that you will have several chances to amend the issue and make up the payments you owe. The IRS will not put you in jail for not being able to pay your taxes if you file your return.

You cannot go to jail for not being able to pay but you can go to jail for ignoring the court. Other tax crimes arepunished as misdemeanors meaning that you could go to prison for up to a yearbe fined up to 100000 200000 if you run a corporation or both. Audits are often random if theyre not triggered by red flags and you could be one of the select few chosen.

You can go to jail for lying on your tax return. It wont be as serious as deportation if you are not paying taxes it is a criminal offense punishable by fine and possibly jail term and thats all. Can You Go To Jail For Not Paying Taxes In Florida.

While you could get prison time for lying on your tax return you cannot be imprisoned for not having the funds to pay your taxes. Understanding Criminal and Civil Charges. Making an honest mistake on.

It only takes 301 of unremitted sales tax to become a felony.

Can You Go To Jail For Not Paying Taxes

Preparing Tax Returns For Inmates The Cpa Journal

Who Is Exempt From Paying Income Taxes Are Some People Really Exempt From Paying Taxes Howstuffworks

What If A Small Business Does Not Pay Taxes

What If A Small Business Does Not Pay Taxes

Decided I Will No Longer Be Paying Taxes What Are They Gonna Do Tax Me More Go Ahead I Won T Pay Those Either Oh I M Going To Prison The One Paid For

Is Jail A Possibility If You Fail To Pay Your Taxes Frost Law Maryland Tax Lawyer

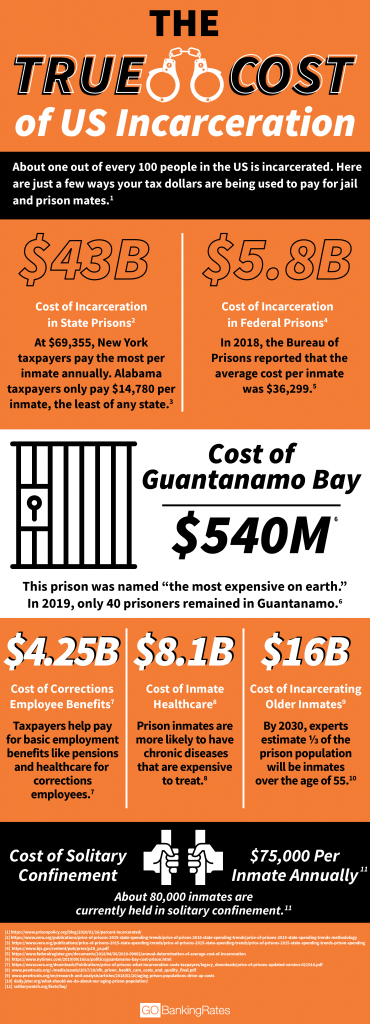

How Much Do Taxpayers Pay For Prisoners Gobankingrates

Who Goes To Prison For Tax Evasion H R Block

16 Dui Cases You Won T Believe Really Happened Infographic Data Charts Infographic Dui

What If A Small Business Does Not Pay Taxes

When You Go To Jail For Tax Evasion But Then You Realize You Re Now Living Off Of Other People S Taxes For Not Paying Taxes N C Memes Paying Taxes Jail

All The Weird Ways People Have Tried To Avoid Paying Taxes History

Graph Showing How Much Minimum Wage Earners In Each State Would Pay If A Single Co Pay Took As Many Hours To Earn As A Co Pa Up Government Doctor Visit Medical

Wesley Snipes Gets 3 Years For Not Filing Tax Returns The New York Times

Rich People Are Getting Away With Not Paying Their Taxes The Atlantic

All The Weird Ways People Have Tried To Avoid Paying Taxes History

Pin By Price Action Cryps On The World Of Bitcoin Paying Taxes Bitcoin Jail